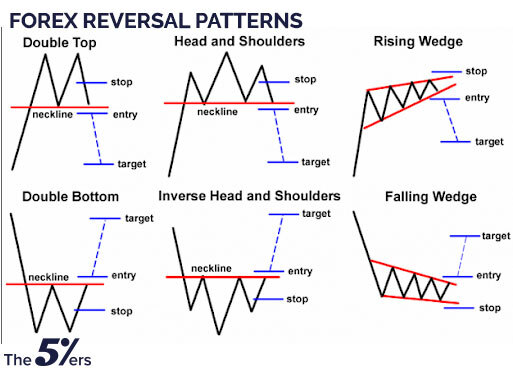

reversal pattern forex

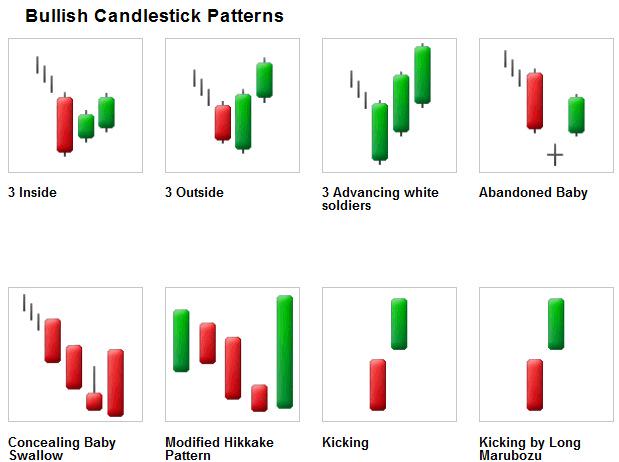

If a White Marubozu forms at the end of a downtrend a reversal is likely. If a Black Marubozu forms at the end of a downtrend a continuation is likely.

Top Forex Reversal Patterns That Every Trader Should Know Forex Training Group

Traders can use this pattern to automatically plot the buy and sell patterns.

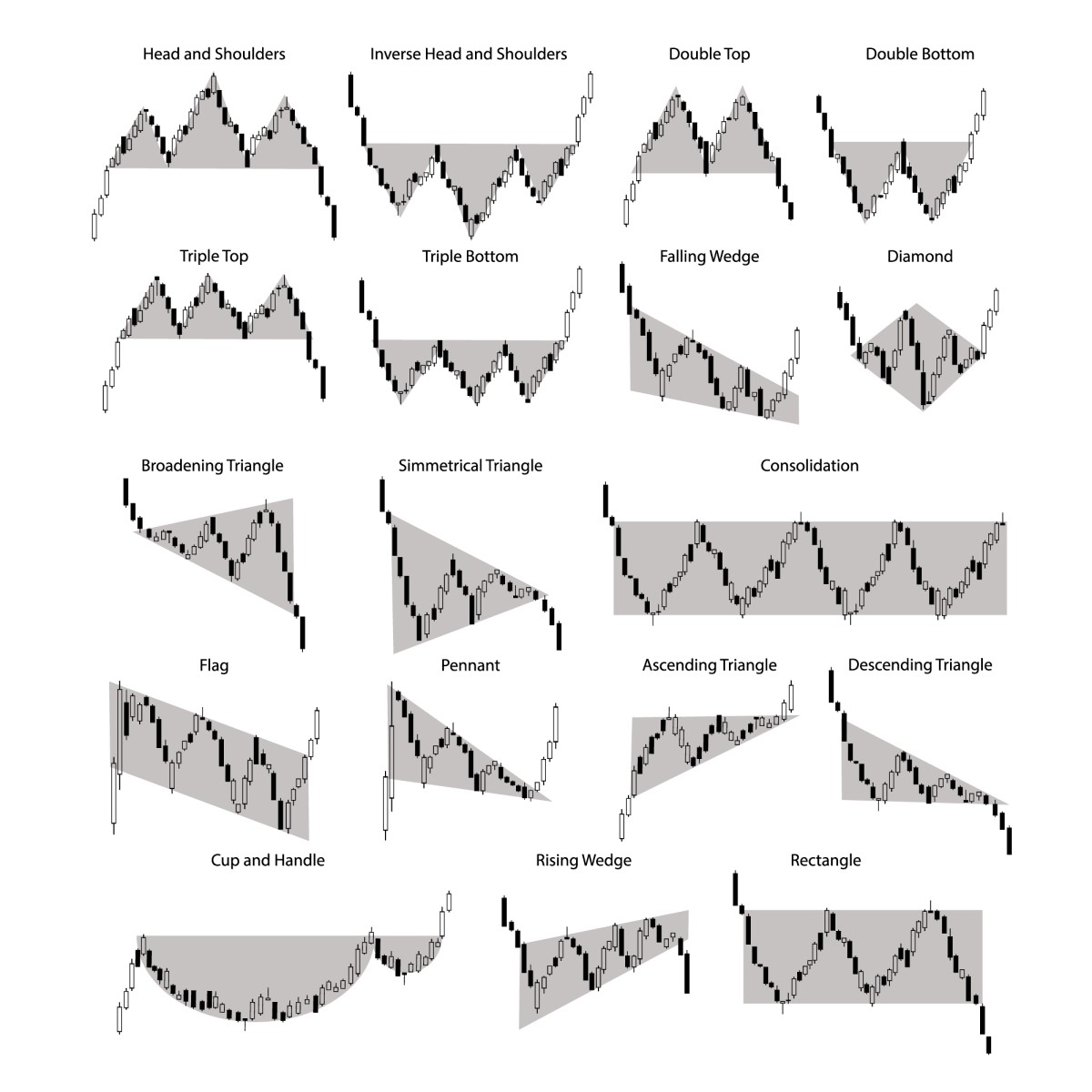

. A forex triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing trend. Some of the earliest technical trading analysis was used to track prices of rice in the 18th century. Free MT4 technical indicators in MetaTrader Market for forex trading and market analysis Market Sections.

Doji candlesticks have the same open and close price or at least their bodies are extremely short. This type of triple candlestick pattern is considered as one of the most potent in-yo-face bullish signals especially when it occurs after an extended downtrend and a short period of consolidation. A Falling Wedge is a bullish chart pattern that takes place in an upward trend and the lines.

These patterns often precede a reversal in the market with. Quasimodo is the most important price action as well as a trend reversal patternThis is the ultimate indication of a trend reversal in price. The Three White Soldiers pattern is formed when three long bullish candles follow a DOWNTREND signaling a reversal has occurred.

Quasimodo is a reversal trading pattern that appears at the end of an uptrend. In a Wedge chart pattern two trend lines converge. The Harmonic Pattern Scanner Indicator is an MT4 trading indicator that automatically plots Harmonic Patterns in real-time.

When you encounter this formation it signals that forex traders are still deciding where to take the pair next. In technical analysis a security price pattern where trend lines drawn above and below a price chart converge into an arrow shape. Unrivaled access premier storytelling and the best of business since 1930.

If a Black Marubozu forms at the end of an uptrend a reversal is likely. It means that the magnitude of price movement within the Wedge pattern is decreasing. Many successful traders trade the Quasimodo forex pattern because this pattern is an indication of the end of the previous trend and the beginning of a new trend.

Download the full version to find new signals that occur recently. A trade captured from the beginning of a trend will give a high risk-reward ratio. Much of the credit for candlestick charting goes to Munehisa Homma 17241803 a rice merchant from Sakata Japan who traded in the Ojima Rice market in Osaka during the Tokugawa ShogunateAccording to Steve Nison however candlestick charting came later probably beginning after.

Past of the market for testing. The Harmonic pattern ideally plots some of the most commonly traded harmonic patterns such as the Butterfly pattern which is bullish and bearish. As a price formation the.

Wedge shaped patterns are thought by technical analysts. Wedges signal a pause in the current trend.

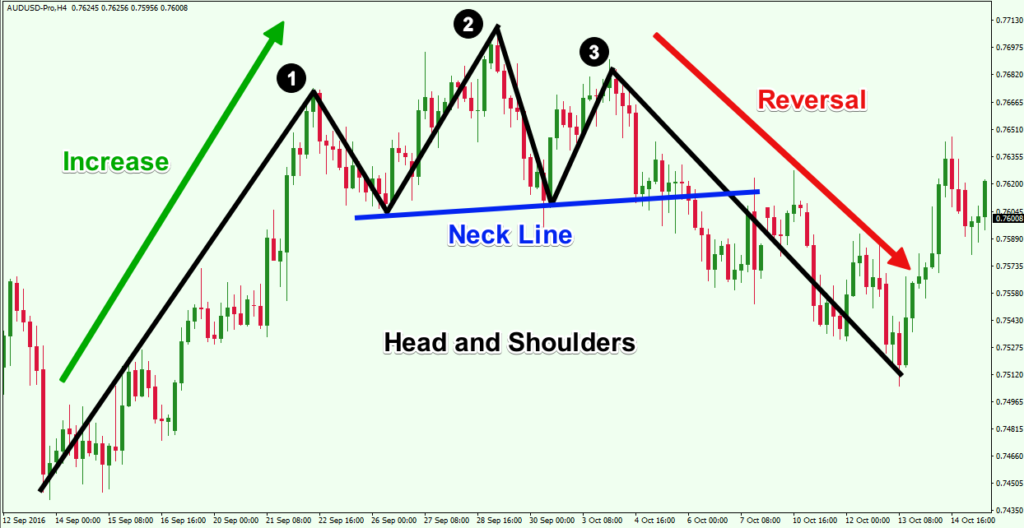

Market Reversals And How To Spot Them

Top Forex Reversal Patterns That Every Trader Should Know Forex Training Group

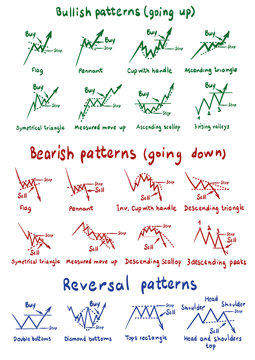

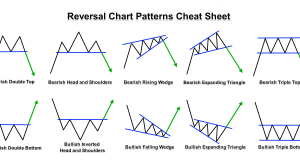

8 Reversal Chart Patterns For Successful Forex Trading Trading Charts Candlestick Patterns Forex Trading

The Most Powerful Reversal Patterns In Forex You Must Know

Chart Pattern Forex Images Browse 44 572 Stock Photos Vectors And Video Adobe Stock

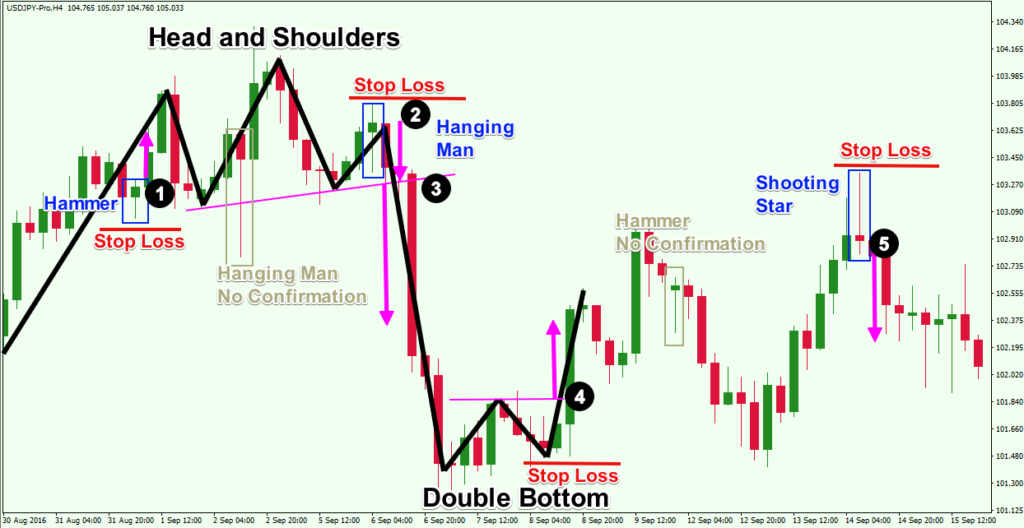

Chart Patterns Vs Candlesticks Patterns The 5 Ers Forex Blog

Trading Reversals Using Bullish Reversal Candlestick Patterns Forex Academy

Classic Trend Reversal Patterns For Fx Eurusd By Unitedsignals Public News Time

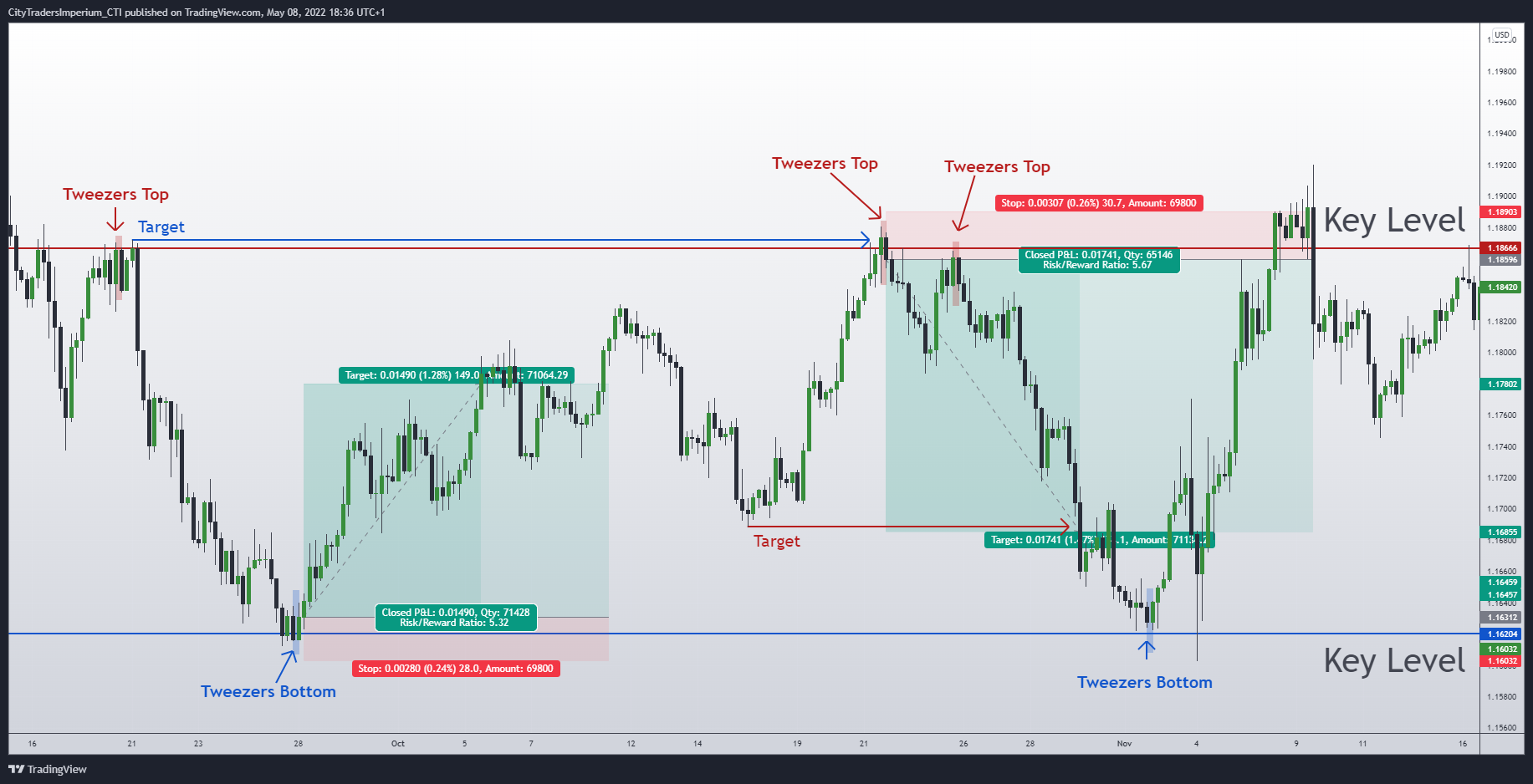

Reversal Patterns How To Identify Trade Them For Fx Eurusd By Vasilytrader Tradingview

Top 3 Reversal Patterns Powerful Simple Price Action Youtube

Best Forex Trading Patterns Different Shapes Common Signals Technical Analysis

1 2 3 Reversal Pattern Strategy Forex Strategies Youtube

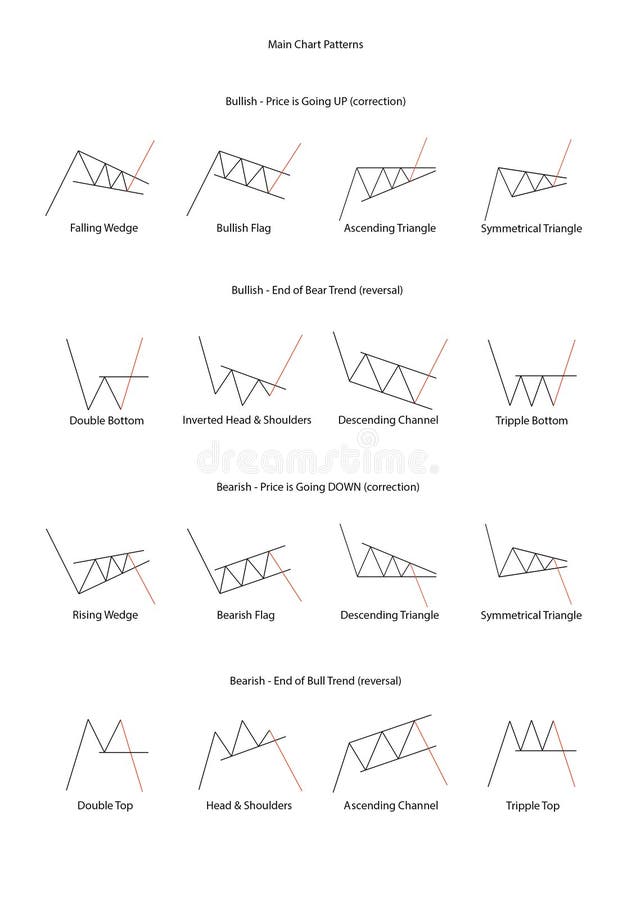

Forex Stock Trade Patterns Main Graphical Price Models Stock Illustration Illustration Of Investment Chart 161598374

Forex Chart Patterns Forex Academy

The Definitive Guide To High Probability Forex Reversal Patterns And How To Trade Them

.png)

How To Distinguish Reversals From Corrections